April 14, 2020

Before we jump into the few financial tips I want to share with you, I want to give you a brief background of my own life so you know where I’m coming from when I talk about finances. We all have such different stories, especially when it comes to money, and we certainly bring that with us when we start to think about finances.

One disclaimer that I will start with is I have never known what it’s like to be poor. Never. My family was not super wealthy, flying around on private planes or going to Europe every Summer, but we were definitely comfortable. We didn’t ever have to worry about having food on the table or a nice warm bed to sleep in at night. I grew up with parents that were very open and honest with what we had and what things truly cost, which I am very grateful for.

I think that gave me a leg up when I started handling all of my own finances early into adulthood because I had my parents as a sounding board to bounce ideas and questions off of.

I am not a financial expert by any means, but over the past few years, I have been very intentional about learning and practicing good financial habits. I made this a priority because my goal was to buy my first home before ever having to rent a house or apartment. I liked the idea of investing my money into a home rather than “giving it away” in rent.

I started saving while I was in college. Hannah gave me Dave Ramsey’s book Total Money Makeover, which transformed the way I thought about money and debt.

Quickly after I read that book I made the goal for myself to become debt free as quickly as possible, which at the time, was easy because I had very little debt to begin with. Because I read Dave Ramsey’s book so early in life compared to many other people, it saved me from making some financial mistakes that I think a lot of twenty somethings get themselves into. I’ve never had a credit card, never rented an apartment, and never had student loans. I bought my first car when I was twenty-two and my first home at twenty-three. I don’t tell you that to brag, but to show you that reaching those goals are possible if you plan ahead and are disciplined in following your plan. Plus, a huge thank you to Hannah for giving me that book!

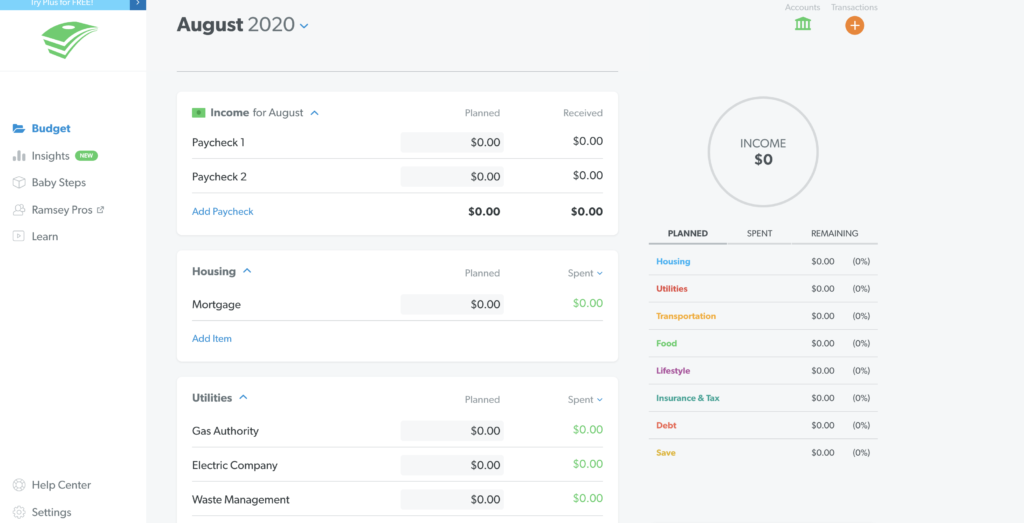

One of the best things I’ve every done is use the Everydollar App. It’s a simple money tracking tool that was created by Dave Ramsey’s company. This is not an ad, I just love it! The App has you input your monthly income and list out all of your monthly expenses into categories. Then, as the month goes along, you plug in all of your transactions. It helps you stay on track, and after a few months of following it, you can start to see where you are over or under spending. After that, you can adjust your budget to go along with your future savings goals.

Listen, I know some people cringe when they hear the word “budget,” but I love it. It allows me to know with certainty where my money is going each month. It keeps me from going into Target and buying $300 worth of home decor and realize that the end of the month that I shouldn’t have done that. It saves me from money guilt, which is one of the worst types of guilt out there, I think!

Now you may be wondering if you should have all of your savings goals in mind before this process, and you totally can, but I really recommend you fill out all of your expenses first and know the exact number that you can minimally live on. That number, of course, will be very different for everyone. Some of you may be living with your parents and have less bills than those of you who already have a home and 2 children. First things first, you need to know what exactly you need to live your life on a monthly basis no extras or frills because then you can start figuring out what you have left to save.

Back to Everydollar…

I’ve used Everydollar for a few years now, and I still love it. It’s almost become a game to me. I love seeing how I can rework the numbers to make my savings dreams come true.

I challenge you to go home, pull out your last month’s bank statement, download the FREE version of Everydollar, and calculate the actual amount of money you need per month to live your life– no fuss no frills. I think it is very rare for people to actually know their numbers, and in times of financial crisis, like COVID-19, knowing your numbers can save you.

I hope this give you some inspiration on what to do when you are at home with nothing to do. I know going to the dentist may sound more fun that finances, but I promise, you won’t regret it!

-Chelsea

Comments Off on How to Track Your Finances